Finessing the Standard Player Contract

This article was written by Michael Haupert

This article was published in 2007 Baseball Research Journal

During the 1998-99 off-season free agent Kevin Brown signed what was at the time the most lucrative contract in baseball history. It guaranteed him just over $106 million for seven years with the opportunity to earn another $8.4 million through bonus clauses. Brown’s contract drew intense interest because of its largesse and the seeming over-indulgence provided by its bonus clauses. My interest in Brown’s contract is not his brief record-setting salary, but rather the incentive and bonus clauses included in the contract.

THE KEVIN BROWN CONTRACT

Brown was the class of the 1998-99 free agent market. He was coming off three consecutive All-Star seasons, bolstered by his 1998 TSN pitcher of the year award and top three finishes in the Cy Young balloting in 1996 and 1998. As a result, he commanded not only top dollar, but significant bargaining leverage for the little “extras” that make headlines in the press and establish a reputation for player agents. Besides the opportunity to increase his salary by eight percent through bonuses, Brown also had clauses in his contract which guaranteed him a suite on the road, eight premium season tickets at Dodger Stadium, and use of a private jet (including ground transportation) 12 times during the season to his home or selected road games, plus all post-season games (of which there were none until he was wearing a Yankee cap in 2004). These latter items were valued at $1.8 million over the life of the contract.

Among the bonus clauses were $250,000 for winning the Cy Young award (and decreasing amounts for finishing second through fifth in the voting), $250,000 for winning the MVP (with decreasing amounts for finishing second through tenth), $100,000 for being voted to the All-Star team, six-figure bonuses for winning the MVP for any post-season series, and $100,000 each for a Gold Glove or Silver Slugger award. As a matter of record, Brown went on to earn only $200,000 of the potential award bonuses.

Brown’s contract was certainly not unusual in its inclusion of bonus and incentive clauses. During the 2000 season three-quarters of all MLB contracts included bonus clauses. While Brown’s clauses were numerous, they were not unique. Tom Goodwin, for example, had a clause allowing him four first-class round-trip air tickets for each member of his family from Dallas to Denver. Jim Edmonds was allowed to request a trade if the Cardinals’ payroll was not among the top15 in the league in 2003 (they were eighth and he’s still a Cardinal). In addition to his $6,000,000 salary in 2000, Mark McGwire earned $1 for each paid admission over 2.8 million (the Cards drew a then team record 3,336,493) and $25,000 for being selected to the All-Star team. He also collected $4,000 per month for a housing allowance, was provided the use of a “luxury class” automobile, 20 first-class airline tickets, the use of a private jet three times during the season, and a suite when on the road. Not bad for a guy who only appeared in 89 games.

BONUS CLAUSES

Bonus clauses can be divided into four general categories: awards, performance, signing, and contract status. The award clauses cover every conceivable award (Rookie of the Year, Comeback Player of the Year, MVP, Cy Young, All-Star, and Gold Glove, to name a few). Performance clauses center on appearances, such as games played or innings pitched, and not on specific achievements—though this was not always the case. Signing bonuses are self-explanatory and contract status clauses include the likes of no-trade, limited trade, and buyout provisions. Miscellaneous clauses also pop up, such as the air transportation and private suite clauses mentioned earlier.

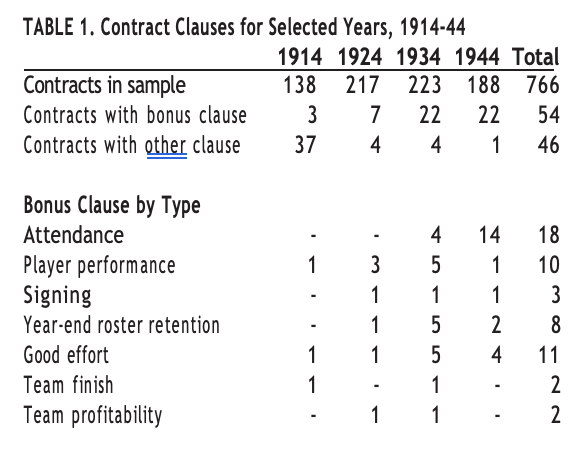

I use a sample of American League player contracts to look at the evolution of bonus clauses in the first half of the 20th century. The years 1914, 1924, 1934, and 1944 were chosen for this analysis. The sample includes contracts for 69 percent of the players who appeared in the American League during those four years, ranging from 47 percent for 1914 to 85 percent for 1934. During those years bonus and incentive clauses were rare, but becoming more common. Only two percent of players received bonus clauses in 1914 (though a total of 29 percent had some kind of contract amendment—most of these were simply the elimination of the 10-day clause—more on this later), less than four percent in 1924, and just over 11 percent in 1934 and 1944. An overview of these bonus clauses can be found in Table 1.

These early bonus clauses focused primarily on specific player achievement, team achievement, and roster bonuses (including signing bonuses). In the four-year sample, only 54 of the 766 contracts (seven percent) had a bonus clause. An additional six percent had a non-pecuniary clause, mostly the elimination of the 10-day clause. Most bonuses were based on team-related accomplishments—either attendance, team finish, or team profitability. The second-most common type of bonus was “good behavior.”

The bonus clause the Red Sox inserted in Carl Reynolds’s 1934 contract is typical of a “good behavior” clause. The Sox promised Reynolds $500 if his performance was “worthy” of a bonus. There were two obvious complications with this bonus clause. The first was the absence of any definition of “worthy,” and the second was the party who determined such a clause—the manager. It certainly set up a potential conflict of interest, but at the same time gave Reynolds the incentive to please his manager that year, as the bonus was worth six percent of his salary.

Team profitability is another example of a one-sided bonus clause. The bottom line for a team is to make money. The surest way to accomplish this is to win ball games. Therefore a clause which relates player pay to team performance seems reasonable. This was accomplished in one of three ways: bonus clauses based on team wins, attendance (the majority of a team’s revenue in the pre-radio and television days), and team profits. The first two are easy for the player to monitor; the latter is as amorphous as the “good behavior” clause and rife with the potential for abuse because the self-interested owner had complete control over information about team finances.

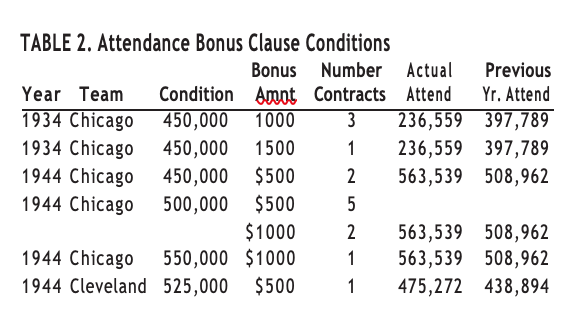

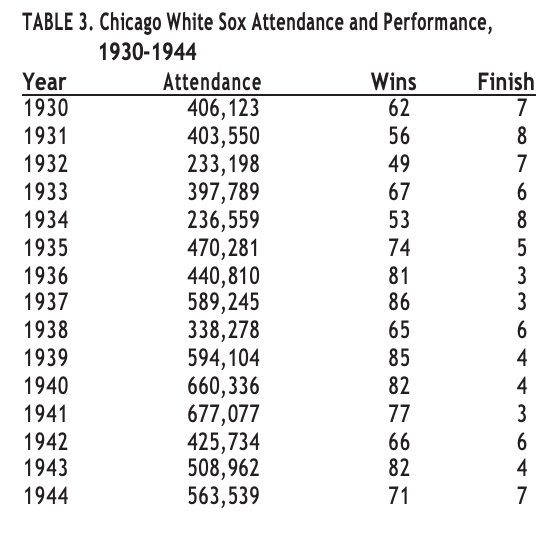

Attendance bonuses first appear in 1934 and seem, on their face, to be unrealistic. For example, in the Depression year of 1934 the White Sox were promising an attendance bonus to four players if the team drew 450,000 fans—a level they had not reached since drawing 494,152 in 1928. This was not a huge leap from the 397,789 they had drawn the previous season, but seemed improbable given the financial situation in the country at the time. In fact, Sox attendance fell by more than 40 percent to 236,559, a long way from having to pay the combined $4,500 in bonuses to Muddy Ruel (.211 with 7 RBIs in 22 games), Mule Haas (.268, 2 HRs, 22 RBIs), Milt Gaston (6-19, 5.85), and Evar Swanson (.298, 10 SB, 71 runs). Not that their performances helped the last-place team attract many fans. Attendance clauses were more common during the war year of 1944, when they accounted for two-thirds of all bonus clauses (see Table 2).

The White Sox were the source of 10 such clauses, and the Indians had one attendance clause contract. A more comprehensive view of White Sox attendance and performance history can be found in Table 3.

WHY BONUS CLAUSES EXIST

So who is deemed worthy of a bonus clause anyway, and why do they exist? In the modern era of competitive sports labor markets, the presence of a bonus condition in the player contract is simply part of the negotiation process. The greater the demand for a particular player, the greater his ability to negotiate bonus clauses (actually, the greater his agent’s ability to negotiate bonus clauses).

The numerous and often complicated bonus clauses in modern contracts serve a number of purposes. First, they are a way for an agent to reap additional funds for a player at a low risk-adjusted cost to the team. This serves to increase the potential value of the player’s contract (and hence the agent’s commission) and enhance the agent’s reputation (which is important for garnering future clients) as a sharp and shrewd negotiator. At the same time, such bonuses are often a cheap way for both sides to save face during negotiations. But why negotiate a bonus clause when you can simply opt for the guaranteed salary?

The salary is, of course, a payment for the performance of the player. But salaries are determined in advance of the actual performance, so that the team is not paying for what is actually being produced, but rather is buying an expected level of production predicted from past performance. Bonus clauses are one way of reducing the downside risk to the team that they will pay for under-performance. If an MVP performance is what the team expects to buy, then an MVP bonus clause will be paid only if the player wins the award. Of course, this means the risk of under-performance is now borne by the player, but since bonus amounts are only a small percentage of the base salary of the best players, the money at risk is not too great. But the presence of the clause allows for the player to cash in on an unexpectedly great season.

The real question is not why bonus clauses exist today, but why and how they prevailed before free agency, in the era of monopsonistic (one employer, many employees) labor markets. After all, if Lu Blue didn’t sign with Detroit in 1924, just what was he going to do? His alternative to his $10,000 salary was not very promising. The average non-agricultural wage in the U.S. in 1924 was less than $1,500. Yet Blue, on top of a salary that paid him more than six times the average U.S. wage, had a bonus clause in his contract that promised him an additional $1,000 if he appeared in 140 games and hit .330. So why would the Tigers find it necessary to include this bonus in his contract?

The standard reason to offer such bonus clauses would be to provide players with the proper incentive to work hard. In the case of Lu, his average had dropped to .284 in 1923 after two consecutive seasons above .300 and his games played decreased for the second consecutive season from 153 in his rookie season of 1921 to 145 in 1922 to 129 in 1923. It is likely that the Tigers included the bonus to spur Blue to put forth just a bit more effort in an attempt to regain his batting prowess. If that was the strategy, it had mixed results. He did not meet either of his bonus conditions in 1924, appearing in only 108 games, but his average improved to .311.

There is a good reason to use bonuses in an effort to give players an incentive to give maximum effort. It is hard for a team to monitor and enforce effort. It is not always clear when a player is dogging it just a bit, actually fatigued during the dog days of August, or playing through a nagging injury. So how to entice a player to monitor himself and deliver his best effort at all times? Give him the incentive via a performance bonus. After all, who better to make sure he is giving his best effort than the player himself? It is more likely that a player will put forth that extra effort when he has money on the line.

This problem is known as moral hazard—that is, after a contract has been signed, one party changes his behavior to the detriment of the other. After signing a contract, a player may be able to reduce his effort a bit, coasting at times, not quite putting out 100 percent. This may be due to fatigue, laziness, or rational energy conservation. After all, if my team trails 12-0 in the ninth inning, is it really necessary for me to dive for that sinking liner? What will I gain if in doing so I injure myself? And pacing oneself for a long season also seems reasonable. I don’t need to leg out that double if the outcome of the game seems certain. I can save myself for later. For the same reason, I may beg out of an occasional game to rest myself. In all of these cases I am not giving my best effort, though that is what fans are paying to see and the owner is paying to hire.

WHO GETS A BONUS CLAUSE

The ability to negotiate bonus clauses is a function of the market demand for a player, which is why bonus clauses are much more common for players who are arbitration or free-agent eligible than for players early in their career. Modern-day players have more and better bonus clauses than their pre-free agency brethren because of their increased bargaining leverage. The old-timers didn’t have the bargaining leverage to get private suites on road trips. In fact, they usually had their first paycheck of the season docked to cover a deposit on their uniform (imagine how that would play out today). The worst news a player could get from the front office was that his uniform deposit was being returned because it was accompanied by a one-way ticket out of town.

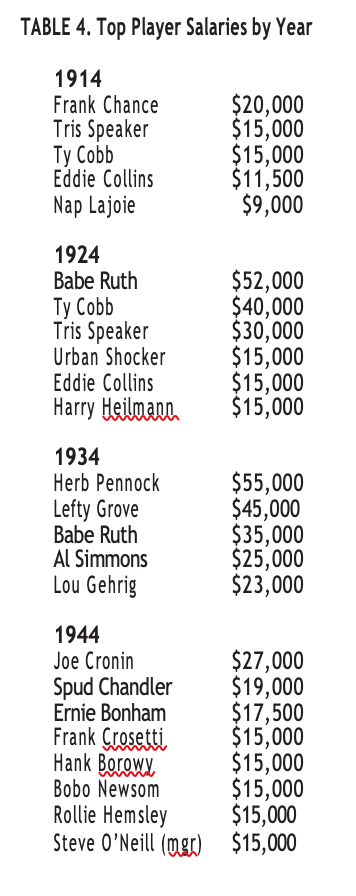

If bargaining leverage is a key to determining bonuses, the natural expectation is that the best players would get bonus clauses. However, it isn’t quite that straightforward. First of all, defining “best” is not easy. I will take the coward’s way out of this one and define the best players as those that earned the highest salary. While teams had complete control over the players and could dictate their wages, it seems reasonable that when they did pay high wages, they would pay those high wages to the best players. Table 4 lists the top five player salaries by year. For the first three years of the sample, this list certainly looks like what we would expect. The top salaries are paid to some of the best players in the history of the game, most of them now in the Hall of Fame. Due to the defection of large numbers of top players into the armed services in 1944, not as many familiar names make the list. However, “best” is a relative term, so I will go with this as the list of players the owners deemed the best.

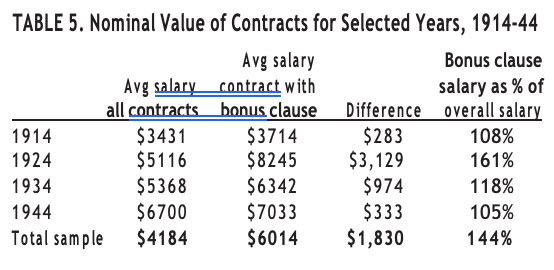

As would be expected, the better players tended to get bonuses. The average salary (not including the value of the bonus) for a contract containing a bonus clause is greater than the average salary in general in each year of the sample. The average player contract for the sample paid $4,184 and the average salary for a contract with a bonus clause was $6,014. The details for each year can be found in Table 5.

While players with bonus clauses on average earn more than others, the player earning the highest salary each year never had a bonus clause in his contract. This could signify that the very best players were paid purely on salary because the owners did not feel they needed to provide any additional incentive for their performance. This would certainly be consistent with the profile of the stereotypical driven superstar who puts forth maximum effort on every occasion. In this case the player and owner are more likely to negotiate purely on salary and not dicker over bonus clauses.

In 1914, the highest-paid player to have a bonus clause was Eddie Collins at $11,500. However, Collins’s bonus clause was non-pecuniary. It was one of the 37 contracts that year that had the 10-day clause eliminated. The highest salaried player who had a financial bonus clause was Bill Carrigan ($8,000 salary) who earned a $2000 bonus as a result of the Red Sox finishing in second place. His contract was the sixth highest in the league. His total earnings that year moved him past Nap Lajoie at $9,000 into fifth place. In 1924, only Babe Ruth ($52,000) and Ty Cobb ($40,000) earned more than Tris Speaker ($30,000). Speaker was the only one of the three who had a bonus clause, which promised to pay him $1,000 if the Indians made at least $100,000 in profit. The contract specifically noted that the accounting firm Ernst and Ernst of Cleveland would determine if this profit level was earned.

In 1934, Babe Ruth was the highest-paid player with a bonus clause. That year he was the third-highest paid player in the league at $35,000, trailing two Red Sox stars, Herb Pennock ($55,000) and Lefty Grove ($45,000). Ruth was paid 25 percent of the net receipts of all exhibition games in which he played during the season, collecting $1697. The reason for this clause is obvious. Even as a fading slugger, Ruth was the biggest draw on the Yankees, and in order to get him to play exhibition games, the Yankees felt it was worth a quarter of the gate.

In 1944, Hal Trosky was the highest-paid player with a bonus clause, earning $12,500. This salary placed him 15th in the league for the season. He earned his $1,000 bonus when White Sox attendance exceeded 550,000.

EARNING THE BONUS

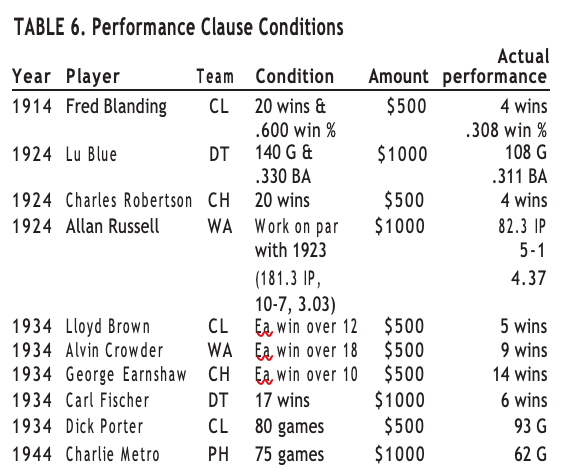

Just because a bonus clause appeared in a contract does not mean that it was actually paid. For example, player-performance clauses were paid only on two of 10 occasions (see Table 6). In 1934, George Earnshaw was paid $7,500 in salary and earned an additional $2,000 by winning 14 games. That’s a hefty 27 percent salary increase for his performance. That same year the Red Sox paid a $500 bonus to Dick Porter for meeting his performance condition of appearing in 80 games. Actually, the Indians inserted the clause into the contract, but Porter played only 13 games for the Tribe before moving on to the Red Sox, for whom he batted .302 in 80 games, padding his salary by nine percent.

There is no way to determine if any of the team-profit or good-performance clauses were actually paid without access to team financial records. To date I have located financial records only for the Yankees and the Phillies. Individual salary data for the Phillies is not available, and the Yankees did not offer any profit or good-performance bonuses during the sample period. No attendance clauses were paid in 1934, but in 1944 the White Sox paid $12,000 in bonuses to 10 players when they drew 563,539 fans to Comiskey Park.

Two of the players earned bonuses for attendance levels beginning at 450,000, seven at 500,000 and one at 550,000. Myril Hoag was the biggest winner, increasing his $7,000 salary by $2,000 due to attendance bonuses. The Sox had drawn 508,962 in 1943, so unlike the Depression-year attendance bonus levels, these were not unrealistic, though with World War II raging on two fronts, continued increases in attendance certainly could not be taken for granted. The Indians did not have to pay their one clause, drawing just over 475,000, far short of the 525,000 bonus threshold.

Both of the team-finish clauses were earned. In 1914, player-manager Bill Carrigan of Boston was promised $2,000 on top of his $8,000 salary if he “helped the team finish first, second or third.” Boston finished in second, 81⁄2 games behind the A’s. It is not clear how much Carrigan really helped the team. In 82 games he batted only .253, though he did lead American League catchers with a .984 fielding average. Since the Sox finished in second, I will presume that his bonus was paid.

The other team-finish bonus clause was promised to Goose Goslin by the Tigers in 1934. He was paid $1,000 on top of his $9,000 salary if the Tigers finished first or second. They won the pennant that year.

When considering only the bonus clauses whose outcome I can determine (performance, attendance, team finish, and signing bonus clauses), 16 out of 33, or 48 percent, were paid out. Both were paid in 1914, one of four in 1924, three of 11 in 1934, and in 1944, 11 of 13 bonuses were earned. That year three of the attendance clauses were for coaches of unidentified teams, so I did not include them in this analysis.

OTHER BONUS CLAUSES

Out of the 46 contracts categorized as “other,” 35 exempted the player from the 10-day clause included in the standard player contract. The infamous 10-day clause allowed a team to void a contract with a 10-day advance notice. In essence, it meant the team could get out of any contract with a mere 10-day’s severance pay and the cost of a train ticket out of town for the player. The elimination of this clause converted the contract to a one-year guarantee. In other words, the team now was obligated to pay the contract for the remainder of the year. Of course, thanks to the reserve clause, they still had the option to renew the contract for the next season if they wished.

No contracts included clauses with exotic conditions like airfare or private suites, but there were still some interesting conditions included in this sample. In 1914 the Red Sox promised Les Nunamacher $300 if he was released, a highly unusual concession for a team to make. They paid the money when he was released and ultimately claimed by the Yankees. More common was a clause like the one the Red Sox gave Dutch Leonard that year. The team promised to cover his round-trip train fare from his Fresno, California, home.

In 1924 the White Sox paid for two round-trip tickets between home and Chicago for each of two players. The Yankees went one better in 1934 by picking up the cost of a round-trip ticket for Mrs. Lazzeri. In 1944, Mike Kreevich and the Browns signed a contract containing a clause that would make Kreevich a free agent at the end of the season if they could not agree on a salary for 1945. They ultimately agreed upon a salary of $11,000 for the 1945 season, his last in the majors. This was a handsome $3,000 raise for Kreevich as a reward for his .301 average over 105 games.

CONCLUSION

While bonus payments were not common in the first half century of modern MLB, they were lucrative relative to salary when they were paid. The average bonus contract went to above-average players, but less than half of those bonuses were actually earned. In modern contracts, bonus clauses are more frequent and are awarded to more players. However, in the few examples I have cited, they don’t tend to be earned any more frequently than they were in the past, and they are a smaller percentage of total salary.