The Roster Depreciation Allowance: How Major League Baseball Teams Turn Profits Into Losses

This article was written by Stephen R. Keeney

This article was published in Spring 2016 Baseball Research Journal

This article was selected for inclusion in SABR 50 at 50: The Society for American Baseball Research’s Fifty Most Essential Contributions to the Game.

“Under current generally accepted accounting principles, I can turn a $4 million profit into a $2 million loss, and I can get every national accounting firm to agree with me.”1

—Paul Beeston, President of the Toronto Blue Jays

Major professional sports are big businesses. And owners of sports teams generally run them accordingly, seeking to strike a balance between costs — including taxes — and revenues which maximizes profits. As Paul Beeston’s words show, sports franchises are even more profitable than leagues and owners like to admit. MLB Commissioner Bud Selig testified before Congress in 2001 that baseball teams were losing hundreds of millions of dollars per year.2 The Congressional committee was skeptical, as was Forbes.com, which concluded that MLB teams likely had an operating profit of around $75 million.3

But if Paul Beeston can turn profits into losses under basic accounting principles, then perhaps Selig and Forbes were both technically “right.” How can this be? One way is tax breaks. Taxing sports franchises is a challenge because the business model and profitability depend heavily upon intangible assets: things that create value but cannot be physically touched, such as television and trademark rights.4 The issues and regulations regarding valuation of franchises are so complex that sports analysts often fail to fully understand them.5 This article discusses one such tax issue: the Roster Depreciation Allowance. The topic has been discussed in simple terms in the popular press, as in this quotation from Time: “owners get to deduct player salaries twice over, as an actual expense (since they’re actually paying them) and as a depreciating asset (like GM would for a factory or FedEx a jet).”6 It has also been discussed in the academic field with in-depth mathematical and economic language and analysis.7 This article presents a middle ground, delving into the history of the Roster Depreciation Allowance and presenting an understanding of the application and consequences of the Roster Depreciation Allowance that is more nuanced than the popular press but accessible to those without a strong background in mathematics or economics.

The Roster Depreciation Allowance (RDA) is a tax law that allows a purchaser to depreciate (or, more accurately, to amortize) almost the entire purchase price of a sports franchise. Depreciation is when a company takes the decrease in value of a tangible asset over a certain period of time as an economic loss in its accounting. If a landscaping company buys a riding mower, the company will take a certain percentage of that mower’s cost each year for a certain number of years as a loss, which counts against the company’s profits. The loss is economic because the company isn’t actually losing any money on the mower, but because the mower is worth less than it was when the company bought it, companies are allowed to count that loss against their revenues for accounting purposes. By lowering the revenues and subsequently the profits of the company, depreciation lowers the company’s taxable income.

The accounting principles behind depreciation are fairly simple. For every transaction, one account must increase, and one must decrease, both by the same dollar amount. When a company spends $1,500 on a riding lawn mower, assuming they pay in cash or an equivalent rather than with a loan, the company’s bank account decreases by $1,500. But now the company owns a mower worth $1,500, so its asset account — the value of the stuff and money it owns — must go up by the same $1,500. That part is simple enough. But after the company uses the mower for several years the mower’s value will be reduced to zero.8 When the mower’s value hits zero, the company’s asset account would have essentially been reduced by $1,500 because they have $1,500 less stuff. But to keep their books balanced, there must be an equal increase somewhere else. That increase comes in the “depreciation expenses” category, which increases a company’s expenses (the money a business spends conducting its business) just as if the company had paid money to an employee. The concept of depreciation simply allows the company to make those adjustments in smaller increments, say 10% per year for 10 years, instead of all at once.

The IRS puts out several rules and regulations which determine the percentage of the purchase price of any given item that is depreciable, over how many years the depreciation is spread, and what methods of depreciation are allowed. Amortization, as used here, is simply depreciation for intangible assets.9 If a company buys an intangible asset, like a patent, it is amortized rather than depreciated, but the same basic process applies. To avoid confusion the rest of this paper will refer to the amortization that takes place under the RDA as depreciation.

The RDA is one of several “gymnastic bookkeeping techniques” businesses and sports franchises use to minimize tax liabilities.10 The RDA is a depreciation of almost the entire purchase price of a sports franchise over 15 years. This means that each year for 15 years, the purchaser (or purchasers) of a professional sports franchise can take a tax deduction based on the purchase price of the franchise. The current RDA allows sports franchise purchasers to depreciate almost 100 percent of the purchase price over the first 15 years after the purchase; a tax deduction of about 6.67 percent of the purchase price per year.11

The RDA is not exactly unique because many businesses depreciate the costs of both tangible (physical, like lawn mowers) and intangible (not physical but still profitable, like patents) assets. But it is unique in that it deals with sports franchises. Unlike riding lawn mowers or patents, which are essentially worthless at some point in time, the value of sports franchises continue to increase. While depreciation generally allows companies to count the loss of value of their assets as costs of operation, the RDA allows companies to count losses on an asset whose value continues to rise.

The current RDA is fairly straightforward, but has not always been that way. Before the first RDA became law in 1976, nobody — not owners, lawyers, accountants, courts, or the IRS — could accurately depreciate the sports franchise as an asset with any consistency.12 Because high barriers to entry meant that buying a sports franchise was and still is a relatively uncommon event, it took lawmakers a while to figure out what to do.

Before moving into the history of the RDA, it is important to understand a few key concepts. The first is the concept of franchise rights. Franchise rights refer to the full panoply of rights associated with being a franchise in a major sports league, such as rights to revenue sharing, rights to trademarks, trade names, licenses, and other intellectual property, rights to regional exclusivity, and all the other rights that come from being a member of the league. The second concept is the distinction between player contracts and player contract rights. Player contracts state how much a player will make over how many years, and will set out what the player has to do to earn that money. In short, player contracts are about a player’s salary. Player contract rights refers to the ownership of the right to enforce the contract and the duty to abide by it. So even though a player may have a $3 million per year salary, if he brings in $4 million in revenue, a person may only pay $500,000 for the contract rights, because he will pay the salary and the price of the contract rights for a total of $3.5 million in exchange for $4 million in revenue. But if the same $3 million player brings in $10 million in revenue a year, then someone may pay $5 million for his contract rights, for a total salary plus purchase price of $8 million in order to gain that $10 million in revenue. In an example that will be examined later, when Bud Selig bought the Seattle Pilots in 1970, he said that he paid $10.2 million to buy the player contract rights of the entire roster, even though the roster’s total salaries were only $607,400.13

Two key court cases came about in the late 1920s which dealt with how baseball teams treat the costs of player contracts. The case of Chicago Nat’l League Ball Club v. Commissioner14 dealt with the Chicago Cubs’ 1927 and 1928 corporate tax returns and the case Commissioner v. Pittsburgh Athletic Co.15 dealt with the Pittsburgh Pirates’ 1928-1930 corporate tax returns. Until 1928, the Pirates had been taking a tax deduction for the difference between all the player contracts they bought and all the player contract they sold in a given year. But now both teams, the Cubs starting in 1927 and the Pirates starting in 1928, had begun taking the entire amount played for player contracts16 in a given year as tax deductions in a that same year.

The reserve clause played a key role in these decisions because it essentially created a perpetual team option contract. Both teams argued that since all player contracts were technically only one-year contracts, they had useful lives of one year and thus the full amount was depreciable in the year in which they were purchased. The IRS argued that the amounts paid for player contracts should be deducted over a period of at least three years because the reserve clause essentially gave the contracts a useful life equal to a player’s entire career. In both cases, the court relied on non-baseball precedent to say that even though a contract has an option to extend its duration, the life of the contract itself was not necessarily changed by the option. So in both cases, the team won.

An early version of the RDA was enacted just over a decade later. When sports entrepreneur Bill Veeck bought the Cleveland Indians in 1946, he persuaded Congress and the IRS to act. Veeck argued that the amount of the purchase price that went towards buying the rights to the player contracts should be treated as a depreciable asset.17 Sports teams could then “double dip” by taking the RDA depreciation for the purchase price of the contracts, how much the new owners paid to old owners for the ability to enforce the contracts, and then deducting the salaries actually paid each year to players as labor costs. Moreover, unlike most assets which can only be depreciated once, the RDA applies anew each time a franchise is purchased.18 This new, clear version of the rules increased the value of franchises, and Veeck quickly capitalized by selling the Indians in 1949.19

With the purchase price of player contracts now a depreciable asset, team buyers began doing what the Chicago court could not: determining how much of the purchase price was for the franchise rights (league membership, regional exclusivity, revenue sharing and licensing rights, etc.) and how much was for the player contracts. The IRS’s stated position was that the price of the franchise rights was not depreciable because it did not have a determinable life (the NFL, NBA, or MLB and their franchises could potentially live on and be profitable forever), but the price of the player contracts was depreciable because they had a determinable life (the contract was only valuable for however many years the player was bound to the club).20 While the franchise rights are the more valuable part of team ownership, buyers wanted to make as much of the purchase price depreciable as possible.21 So buyers began allocating huge percentages of the purchase price to the player contracts and away from the franchise rights.

The NFL granted an expansion franchise in 1965 which became the Atlanta Falcons.22 The new owners tried to depreciate both the cost of the contracts of the 42 players acquired via the expansion draft and the cost of the Falcons’ franchise right to a share of the NFL television revenues.23 The IRS asserted deficiencies, arguing that the owners allocated too much of the purchase price to the player contracts and not enough to the franchise rights.24 The IRS also argued that the “mass asset rule” should apply to prevent the Falcons from dividing the purchase price between the franchise rights and the player contracts. The “mass asset rule” prevents depreciation of intangible assets of indeterminate life (such as rights to television revenue) if they are inseparable from intangible assets of determinable life (such as player contracts). The IRS argued that it was impossible to separate the costs of becoming an NFL franchise and the costs expended to acquire the players on its roster, and that therefore the “mass asset rule” should apply.

The court disagreed. It held that the “mass asset rule” did not apply because the player contracts 1) had their own value separate from the franchise rights, and 2) had a limited useful life which could be ascertained with reasonable accuracy.25So the court allowed the Falcons to separate and depreciate the cost of player contracts from the rest of the intangibles.26 The court also held that the television rights bundle could not be depreciated because it was of indeterminable length, running as long as the franchise is part of the NFL.27 Thus, franchise owners benefitted the most when they attributed more of the purchase price to player contracts instead of to the franchise rights, so that’s exactly what they started doing.

Former MLB commissioner Bud Selig took the practice of allocating costs towards player contracts in order to maximize depreciation deductions to new heights when he bought the Seattle Pilots in 1970. Selig bought the Pilots for $10.8 million.28 He allocated 94 percent of the purchase price (or about $10.2 million) to the purchase of player contracts, even though the contracts themselves were only for $607,400 worth of salaries, according to Baseball-Almanac.com.29,30 The remaining purchase price was allocated to the equipment and supplies ($100,000) and the value of the franchise ($500,000).31 The court upheld this allocation.32

In response to Selig’s allocation (but before the decision upholding it came down) the IRS and Congress acted to prevent such allocations in the future. Congress enacted Section 1056, which regulated the tax treatment of player contracts. Subsections (a)-(c) dealt with the “basis” of player contracts.33 “Basis” is a tax term describing the amount of money “put into” an asset — minus any depreciation deductions taken — by the owner. This determines the amount of taxable profit/loss the owner will realize on a subsequent sale of the asset.34 Subsection (d) creates a presumption that no more than 50 percent of the purchase price of a sports franchise could be allocated to player contracts, unless the purchaser establishes to the IRS that a higher percentage is proper. This amount could then be depreciated over a five-year period (rather than over the lives of the individual contracts). This law created the 50/5 rule: 50 percent of the total purchase price of the franchise could be depreciated over five years.

The 50/5 rule streamlined sports franchise bookkeeping by making all the purchased contract rights one large, depreciable asset. This may have been an attempt to get courts to stop evaluating the reasonableness of the contract rights purchase price first and allocating the remainder to franchise rights second.35 However, since it created only a presumption and not a rule, the IRS continued to struggle against franchise buyers who argued that more than 50% of the purchase price was for the player contracts.36

Around the turn of the century, Congress drastically changed the RDA. In 1993, Congress had passed a tax law called Section 197, which gave all businesses the ability to depreciate the purchase price of intangible assets, but specifically excluded sports franchises.37,38 So the 50/5 rule in Section 1056 continued to apply to professional sports franchises. Then Congress passed the American Jobs Creation Act of 2004. As part of this Act, Section 1056 was repealed, and the purchase price of sports franchises became subject to the 15-year depreciation rules applicable to other intangible assets under Section 197.39 “Section 197 allows an amortized deduction for the capitalized costs of [things listed in Section 197].”40 These intangibles include “workforce in place” (player contract rights), as well as “any franchise, trademark, or trade name.”41,42 Thus, the specific exclusion of sports franchises from intangible assets was ended.43 Under this new 100/15 rule, almost the full purchase price of a franchise is depreciable over 15 years.44

The RDA is perhaps best understood through hypotheticals. An analysis of the 2004 rule gives the following example:

Buyer (B) pays Seller (S) $350 million for an MLB franchise. $40 million represents the costs of all tangible assets (uniforms, bats, balls, mascot costumes, etc.) and the intangible assets which are not the franchise itself or the player contracts (such as a stadium lease). The remaining $310 million is a depreciable asset, just as if B had bought a factory or patent.45

As this example illustrates, not all intangible assets are depreciable under the RDA, such as the stadium lease46 mentioned above. This leaves room for the old-fashioned disputes about allocation, but the amount of money in contention is much smaller.

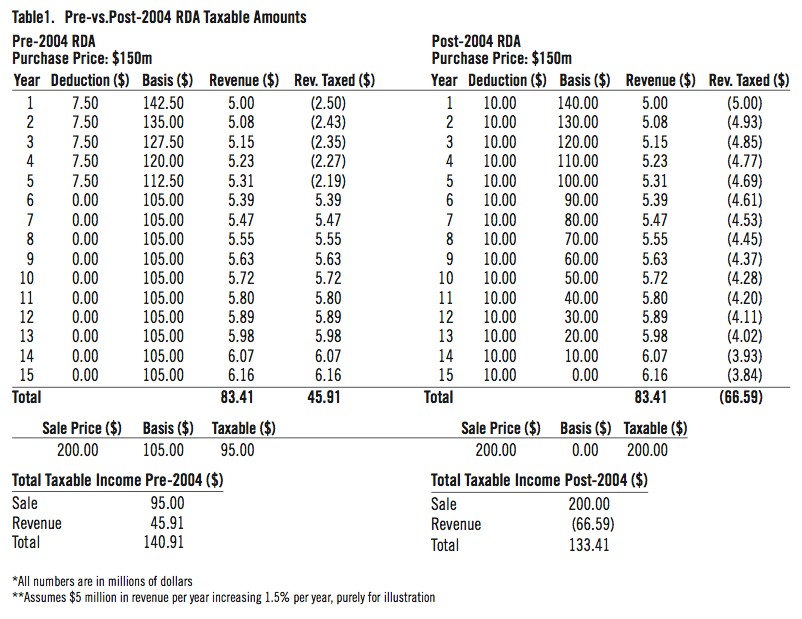

For an example of the difference between the old and new incarnations of the RDA, consider the following: Assume that an investor, or a group of investors, purchased a sports franchise for $150 million total. Under the old 50/5 rule, the franchise would be able to depreciate $75 million (50 percent) over five years, or $15 million dollars per year. That means that $15 million worth of revenues are not taxed. Assuming a tax rate of 35 percent, that $15 million in revenue would have generated income tax of $5.25 million.47 Multiplied by five years means $26.25 millionin tax savings for the franchise.

Now, let’s use the same hypothetical for the current RDA. A purchaser or group of purchasers buys a sports franchise for $150 million, with $100 million of that being for the franchise and player contract rights.48 Under the 100/15 rule, the franchise can depreciate $100 million over fifteen years, or about $6.67 million per year. That means that $6.67 million of revenues per year are not taxed. Assuming a tax rate of 35 percent, the franchise owners gain approximately $2.33 million in taxes, which they would have had to pay the IRS without the RDA. Multiplied by fifteen years, that equals about $35 million in tax savings.

These examples have two caveats. One is that, in the examples above, if an owner buys a team for $150 million he will almost certainly allocate far more than $100 million to the franchise and player rights ($100 million is only 67 percent of $150 million, but remember Bud Selig allocated 94 percent to player rights alone). Thus, the tax advantages to the owners under the current rules would be even greater than the example illustrates. The last ten times a major sports franchise (NHL, NFL, NBA, or MLB) was sold, the prices ranged from $170 million to $2.15 billion, with five of those ten between $200 and $600 million.49 So, if a team were purchased for $400 million and the owners allocated $376 million to player rights and other depreciable intangibles ($376 million is 94% of the purchase price, which Bud Selig got away with), they could depreciate just under $25.1 million per year, which at a 35 percent tax rate would be savings of $8.77 million per year to the owners.

The second caveat is that nothing in this paper discusses changes to the depreciable amount. Theoretically, a franchise would acquire and sell the rights of individual players and would thus have to realize gains or losses on each sale, and likely apply the RDA to each new player contract it acquires, depending on how it does its accounting. Since these examples are illustrative only, we are only dealing with the initial purchase of the all player contracts the franchise owns at the time of the sale.

This is a good point to provide greater context for the numbers we’ve been discussing to see the real impact of the RDA and the 2004 changes. As discussed earlier, the RDA creates tax savings for owners. But these breaks are only temporary. We have to remember the concepts of depreciation and basis discussed above. When you depreciate an asset, your basis in that asset decreases. If you sell that asset, you are taxed on the portion of that income which exceeds your basis. Remember that lawn mower from our landscaping company from before? Let’s say the company buys a lawn mower for $1,500. Its basis in the lawn mower is $1,500. The company then depreciates $150 (10%) per year for six years, for a total depreciation of $900. The company’s basis in the lawn mower is decreased by that $900 of depreciation, so that the company’s basis is now $600. So after owning the lawn mower for six years, the company now sells it to someone else for $750. The company will have to pay tax on the difference between the $750 it received for the lawn mower and its $600 basis in the lawn mower, which is $150 of taxable income.

The same is true of sports franchises under the RDA. For every dollar a franchise takes as depreciation, they will have to pay taxes on another dollar of profit from the sale of the franchise. So the RDA itself does not really affect the dollar amount of taxes paid by a franchise. But it does do two other things. First, because the amount of the depreciation allowed was increased from 50% of the purchase price to almost 100% of the purchase price, it allows more revenue to go untaxed (see Table 1). Second, by using the RDA and other perfectly legitimate accounting methods, franchises make revenue disappear from the profit line. As stated, this untaxed revenue will eventually be paid back.

(Click image to enlarge.)

These tax breaks create a type of deferred-tax situation – a situation where companies can use accounting to delay paying current taxes due until a later date – because they allow the franchise owners to keep more money now and make up for taxes due later. Because every $1 of depreciation decreases basis by $1, at a 35% tax rate the owners are saving $.35 now, but will have to pay that $.35 back later if they sell the franchise. Of course, these savings the owners get are going to be generating more income for them while the total they owe the IRS will stay the same, effectively acting as an interest-free loan from the government to the owners.50 This article is not trying to decry some perceived injustice in the existence of the RDA – but it is something sports fans should be aware of when they are considering financial numbers put out by both the media and the teams themselves.

Congress placed sports franchises under the general law for intangible asset depreciation in 2004 for several reasons. First, it made the rules more uniform across industries. Second, the clearer rules were meant to minimize disputes regarding proper allocation, and in turn to reduce the IRS’s administrative and enforcement costs.51 Finally, supporters argued that it would increase tax payments by about $381 million over ten years.52 While the deductible amount doubled, the amortization time period tripled, which would increase tax bills in the short term. As the above hypotheticals show, while the amortizable amount increased from 50 to almost 100 percent, the dollar amount amortized each year decreased; meaning that in the early years the teams would have more taxable income. While the 50/5 example above allowed an annual deduction of $5.25 million, the 100/15 example only allowed an annual deduction of $2.33 million, increasing the team’s taxable income for the first five years. Of course, after those five years, as the depreciation continued to apply, the increased percentage meant that even more money was safe from taxation than before.

By doubling the amount of tax deductions a team could take — provided, of course, that the new owners hang on to the team for the full 15 years — the new RDA increased franchise values. Higher depreciation totals meant more tax deductions and more untaxed profits for owners in the long run. Experts in the field theorized that the average values of sports franchises would increase by five percent.53 One economic report argued that average value would in fact increase by 11.6 percent.54

Further, for many teams, even the lower depreciation amounts exceed taxable income for each of the 15 years, allowing the owners to pass the paper losses on to their personal income tax liability.55 For example, a Los Angeles group of investors bought the Dodgers for $2.15 billion in 2012.56 Thus, it can take over $143 million per year as a deduction, which is a tax savings of just over $50 million per year for the owners, again assuming a 35 percent tax rate.57 The elongated time frame means that the Dodgers’ new owners can extend the tax benefits to their private income taxes as business losses for ten years longer than under the old rules, but more importantly the extended coverage of the new RDA , from 50% to almost 100% of purchase price, allows them to almost double the total deductible about.58 If Paul Beeston could turn a $4 million profit into a $2 million loss, just imagine how much profit the Dodgers’ owners could turn into losses with $143 million in deductions.

There have been several examples in recent sports history that illustrate the effects of the RDA on the business of sports. In 1974, before the modern rules, only 5 of 27 professional basketball teams reported a profit.59 This history of paper losses has continued under the new rules. In 2011, with the Collective Bargaining Agreement between the league and players expiring, the NBA stated that 22 of its 30 teams were losing money.60 As a lockout loomed, NBA players argued that the “losses” suffered by teams were paper rather than real.61 As a former director of the MLB Players Association once said, if “[y]ou go through The Sporting News of the last 100 years, and you will find two things are always true. You never have enough pitchers, and nobody ever made money.”62

Forbes reported in August 2013 that the Houston Astros, who had finished with the worst record in Major League Baseball each year from 2011 through 2013, were on pace to make $99 million in profit in 2013 — the most of any team in baseball history.63 The Astros responded that their numbers were not near that amount. The difference is because the Astros, unlike Forbes, included non-cash losses, such as the RDA, in its calculation.64 Current Astros owner Jim Crane bought the team in 2011. Between then and 2013, he cut player salaries from $77 million to $13 million.65 According to the Sports Business Journal, Crane paid about $700 million for the team.66 This means that the Astros would get about $46.7 million per year in paper losses associated with acquiring player contracts, despite paying actual salary amounts as low as $13 million. If you multiply the $46.7 million per year deduction by 35 percent, the RDA allows the team to keep about $16.3 million dollars per year which it would have had to pay in taxes. That’s more than enough to double the salary of the entire 2013 roster. So, with the help of the RDA, the Astros are taking a large paper loss as well as decreasing labor expenses, greately increasing their profit margin. If you subtract the $46.7 million in depreciation losses from the Forbes projection of $99 million in profits, it’s easy to see why the Astros claimed the numbers were so far off. It’s also easy to see how such vastly profitable businesses as sports franchises can say they are not making money with a straight face.

If you were to get on the public address system at any ballpark in America during a baseball game and ask for a show of hands on how many people are interested in how their teams account for depreciation of intangible assets, among the sea of boos you would probably find no hands up. But the people who run the teams are very interested in limiting their tax liability. It allows them to either pocket more money in profits or to pay better players to win more games. And as fans and society continue to take an increasingly academic look at professional sports, the Roster Depreciation Allowance is a crucial consideration to pay attention to in the economics of professional sports. The next time you see an article about the financial condition of your favorite team, you’ll know that there is much more going on in the books than meets the eye.

STEPHEN R. KEENEY is a lifelong Reds fan and a new SABR member. He graduated from Miami University in 2010 with degrees in History and International Studies, and from Northern Kentucky University’s Chase College of Law in 2013. After passing the bar exam he moved from Cincinnati to Dayton, where he works as a union staff representative and lives with his wife, Christine.

Notes

1 Dan Alexander, “Can Houston Astros Really Be Losing Money Despite Rock-Bottom Payroll?,” Forbes.com, August 29, 2013, http://www.forbes.com/sites/danalexander/2013/08/29/can-houston-astros-really-be-losing-money-despite-rock-bottom-payroll/.

2 Richard Sandomir, “Selig Defends His Plan of Contraction to Congress,” December 7, 2001, http://www.nytimes.com/2001/12/07/sports/baseball-selig-defends-his-plan-of-contraction-to-congress.html.

3 Michael Ozanian, “Is Baseball Really Broke?,” April 3, 2002, http://www.forbes.com/2002/04/01/0401baseball.html.

4 See Robert Holo and Jonathan Talansky, “Taxing the Business of Sports,” 9 Fla. Tax Rev. 161 (2008): 184 (discussing current issues in taxing sports at the entity level).

5 See Tommy Craggs, “Exclusive: How an NBA Team Makes Money Disappear [UPDATE WITH CORRECTION],” Deadspin.com, June 30, 2011, http://deadspin.com/5816870/exclusive-how-and-why-an-nba-team-makes-a-7-million-profit-look-like-a-28-million-loss (misconstruing the nature of the allowance and implying that it is of unlimited duration rather than the current 15-year limit); and Larry Coon, “Is the NBA Really Losing Money?,” ESPN.com, July 12, 2011, http://sports.espn.go.com/nba/columns/story?columnist=coon_larry&page=NBAFinancials-110630 (asserting the pre-2004 law of the Roster Depreciation Allowance as current in 2011).

6 Gary Belsky, “Why $1.5 Billion for the Dodgers Might be a Bargain,” Time.com, March 9, 2012, http://business.time.com/2012/03/09/why-1-5-billion-for-the-dodgers-might-turn-out-to-be-a-bargain/.

7 N. Edward Coulson and Rodney Fort, Tax Revisions of 2004 and Pro Sports Team Ownership, available at http://econ.la.psu.edu/~ecoulson/veeck.pdf .

8 The mower may have “scrap value” which a company may account for, but for practical and illustrative purposes we will assume the mower becomes worth $0 at the end of its useful life.

9 Amortization is a general name for the spreading out of payments over a long period of time into equal amounts. In terms of loans such as mortgages and car loan, amortization refers to spreading out the total debt into equal regular payments rather than paying it all at once at the end of the loan period. In terms of business assets, amortization refers to the process of spreading the cost of an intangible asset’s depreciation into equal parts over a period of time, and taking the depreciation as a paper loss at regular intervals.

10 Ron Maierhofer, No Money Down: How to Buy a Sports Franchise, A Journey Through an American Dream (Dog Ear Publishing, 2009), 27.

11 26 U.S.C. § 197.

12 26 U.S.C. § 1056, effective January 1, 1976 through 2004. See http://law.justia.com/codes/us/1996/title26/chap1/subchapo/partiv/sec1056 and http://uscode.house.gov/view.xhtml?req=granuleid:USC-prelim-title26-section1056&num=0&edition=prelim.

13 “1969 Seattle Pilots Roster,” Baseball-Almanac.com, http://www.baseball-almanac.com/teamstats/roster.php?y=1969&t=SE1. The $607,400 team total salary comes from adding together the salaries listed on the page cited.

14 Chicago Nat’l League Ball Club v. Commissioner, 1933 WL 4911 (B.T.A.) (1933), affirmed sub nom Commissioner of Internal Revenue v. Chicago Nat’l League Ball Club, 74 F.2d 1010 (1935).

15 Commissioner of Internal Revenue v. Pittsburgh Athletic Co., 72 F.2d 883 (1934).

16 The distinction between player contract rights and player salaries is key here: the teams were deducting the costs of acquiring the rights of the player as business expenses, and also claiming the salaries paid to players as labor costs.

17 See Jason A. Winfree & Mark S. Rosentraub, Sports Finance and Management (Boca Raton, Fl.: CRC Press, 2012), 428-429 (discussing the history of the RDA), and Coulson, supra note 7 (discussing Bill Veeck’s role in creating the RDA and the economic consequences).

18 Winfree, Sports Finance, 429.

19 Ibid.

20 Ibid, at 197. See also, Rev. Rul. 71-137, 1971-1 C.B. 104.

21 Talansky, “Taxing…Sports,” 193.

22 “Atlanta Falcons Team Page,” NFL.com, http://www.nfl.com/teams/atlantafalcons/profile?team=ATL.

23 See Laird v. U.S., 556 F. 2d. 1224, 1226-1230 (5th Cir. 1977) (upholding the Falcons’ allocation of purchase price).

24 Ibid.

25 Ibid, 1232-1233.

26 Ibid.

27 Ibid., 1235-1237.

28 See Selig v. U.S., 740 F. 2d. 572, 574 (7th Cir. 1984) (upholding the allocation made by Selig).

29 Winfree, Sports Finance, 429.

30 “1969 Seattle Pilots Roster,” Baseball-Almanac.com, http://www.baseball-almanac.com/teamstats/roster.php?y=1969&t=SE1.

31 Selig, 740 F. 2d. at 575.

32 Talansky, “Taxing…Sports,” 189 (one commentator referred to the opinion as one that “reads more like a Ken Burns paean to baseball than a legal opinion” because the court talked as much about the history of baseball in America as it dibid about the applicable law).

33 26 U.S.C. § 1056.

34 For example, if you buy a house for $200,000 and make $50,000 in upgrades, your basis in the house is $250,000. If you are a landlord and you have depreciated $100,000 of the same house on your books, your basis is $150,000 ($250,000 – $100,000). If you sell the house, your taxable income is the amount you got for the house minus your basis.

35 Talansky, “Taxing…Sports,” 193.

36 Ibid., at 197.

37 26 U.S.C. § 197.

38 “Notes,”26 U.S.C. § 197, Cornell Law, https://www.law.cornell.edu/uscode/text/26/197.

39 Talansky, “Taxing…Sports,” 200.

40 26 C.F.R. § 1.197-2.

41 26 U.S.C. § 197(d)(1)(C)(i).

42 26 U.S.C. § 197(d)(1)(F).

43 Talansky, “Taxing…Sports,” 196. See also, Complete Analysis of the American Jobs Creation Act of 2004, Chapter 300 Cost Recovery, “315 Professional Sports Franchises are Made Subject to 15-Year Amortization; Special Basis Allocation and Depreciation Recapture Rules for Players Contracts are Repealed,” 2004 CATA 315, 2004 WL 2318514 (briefly explaining the history of allocation debates between purchasers and the IRS).

44 The regular rules for depreciation of tangible assets continues to apply to all tangible things the new owners get, such as uniforms, bats, balls, equipment, etc.

45 See Complete Analysis, note 33 (paraphrases, not quoted).

46 Intangibles like the stadium lease, which are not related to franchise rights or player contracts, may be depreciable under other sections of the tax code, but they are not included in the RDA and their treatment is outside the scope of this paper.

47 I chose a 35% tax rate because it is the second-highest personal income tax rate and the highest corporate income tax rate. The actual tax rate — that rate the entity should pay under the tax code — will depend upon how the ownership entity is taxed (whether pass-through like a partnership or as an entity like a corporation), the net income of the individuals or entity, and whether the income is taxed at the much lower capital gains tax rate. The effective tax rate — the percent actually paid in taxes — will depend upon the expenses and deductions of the individual team or owners, and several other factors which may be too numerous to use in an illustrative example.

48 In both examples the team is purchased for $150 million, but in the post-2004 example the depreciation is based on $100 million rather than $150 million. This is because the pre-2004 50/5 rule applied to the total purchase price paid for the franchise, while the post-2004 100/15 rule applies only to the portion of the purchase price paid for intangible assets like franchise rights, player contract rights, and trademarks.

49 Dan Primack and Daniel Roberts, “American Sports Teams: All Worth More Than You Think,” Fortune.com, http://fortune.com/2014/06/05/american-sports-teams-all-worth-more-than-you-think/.

50 This situation is very similar to a tax deferment. For more on tax deferments, see Stephen Foley, “The $62 bn Secret of Warren Buffett’s Success,” Financial Times, FT.com, March 4, 2015, available at http://www.ft.com/cms/s/2/9c690e44-c1d2-11e4-abb3-00144feab7de.html#slide0, and Joshua Kennon, “Using Deferred Taxes to Increase Your Investment Returns,” available at http://beginnersinvest.about.com/od/capitalgainstax/a/Using-Deferred-Taxes-To-Increase-Your-Investment-Returns.htm.

51 Ibid.

52 Talansky, “Taxing…Sports,” 202, and Coulson, “Tax Revisions of 2004,” at 1.

53 Talansky, “Taxing…Sports,” 203, and Coulson, “Tax Revisions of 2004,” abstract.

54 Ibid., at 18.

55 Depending on what type of business entity owned the team. Most teams are owned by partnerships, which generally allow the tax benefits to pass through to the owners’ individual income tax liabilities.

56 Sean Leahy, “Bankrupt to Big Bucks: The New Economics of the Los Angeles Dodgers,” San Diego State University Sports MBA ’13, http://sandiegostatesmba13.blogspot.com/2012/09/bankrupt-to-big-bucks-new-economics-of.html.

57 Ibid.

58 Alexander, “Can Houston Astros Really Be Losing Money.” In fact, the last 6 World Series winners combined have made less than $99 million.

59 Talansky, “Taxing…Sports,” 192-193.

60 Coon, “Is the NBA Really Losing Money?”

61 Coon, “Is the NBA Really Losing Money?”

62 Talansky, “Taxing…Sports,” 184, n. 71.

63 Dan Alexander, “2013 Houston Astros: Baseball’s Worst Team is the Most Profitable in History,” Forbes.com, August 26, 2013, http://www.forbes.com/sites/danalexander/2013/08/26/2013-houston-astros-baseballs-worst-team-is-most-profitable-in-history/.

64 Alexander, “Can Houston Astros Really Be Losing Money.”

65 Alexander, “2013 Houston Astros.”

66 Daniel Kaplan, “Crane’s $220M Loan from BofA to Finance Purchase of Astros has ‘Recession-Era Structure,’” SportsBusinessDaily.com, June 6, 2011 http://www.sportsbusinessdaily.com/Journal/Issues/2011/06/06/Finance/Astros.aspx.